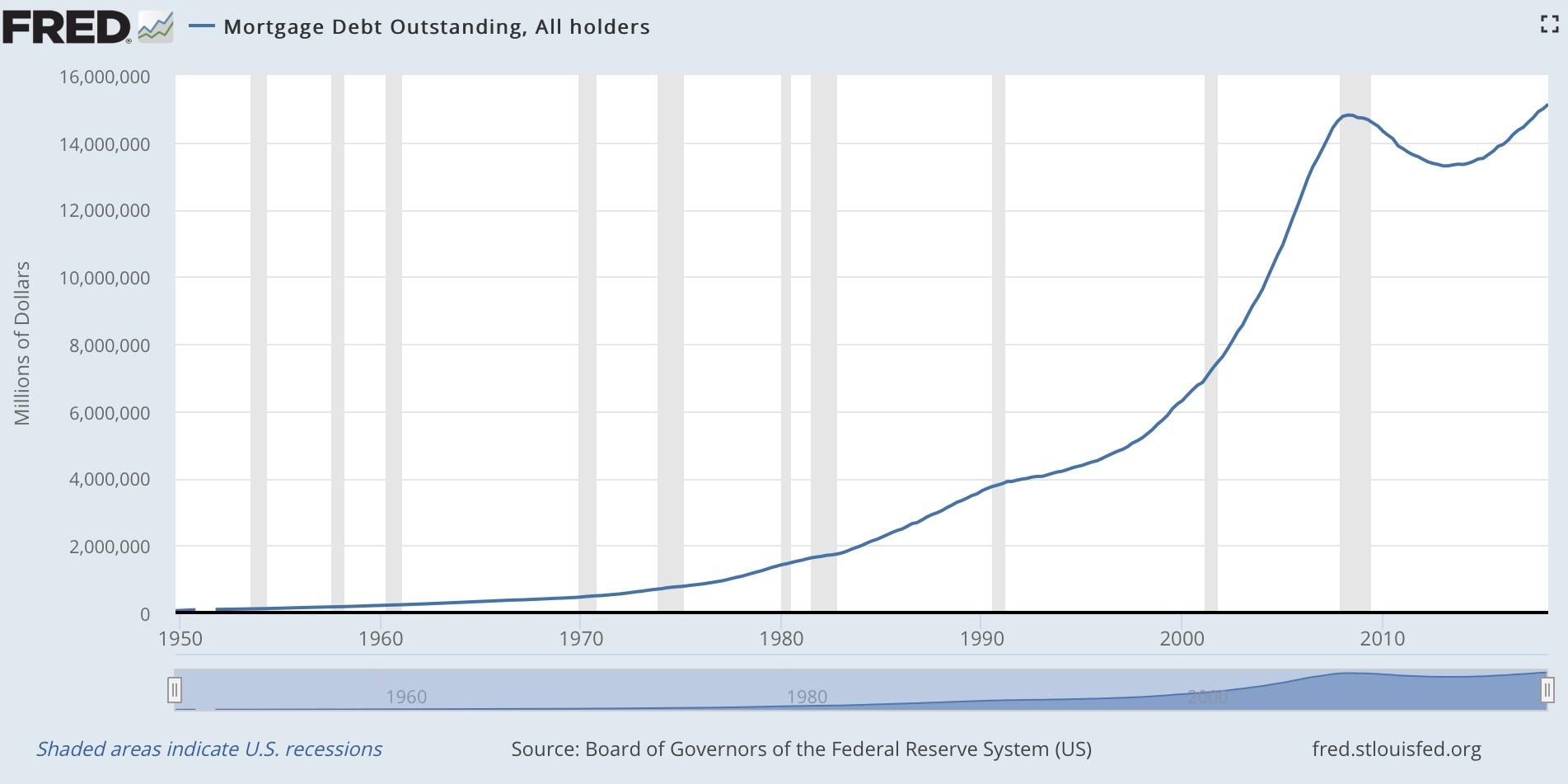

Compare Standard and Premium Digital here.Īny changes made can be done at any time and will become effective at the end of the trial period, allowing you to retain full access for 4 weeks, even if you downgrade or cancel. The Most Splendid Housing-Inflation Bubbles in America with WTF Spikes in Seattle & Los Angeles by Wolf Richter 196 Comments But condo prices in the San Francisco Bay Area fell year-over-year again, and in New York City have been flat for years. You may also opt to downgrade to Standard Digital, a robust journalistic offering that fulfils many user’s needs. If you’d like to retain your premium access and save 20%, you can opt to pay annually at the end of the trial. According to the Office for National Statistics. If you do nothing, you will be auto-enrolled in our premium digital monthly subscription plan and retain complete access for $69 per month.įor cost savings, you can change your plan at any time online in the “Settings & Account” section. Even after the stamp duty deadline passed in September 2021, property prices continued to defy gravity. For a full comparison of Standard and Premium Digital, click here.Ĭhange the plan you will roll onto at any time during your trial by visiting the “Settings & Account” section. Here are three signs that the housing market is creeping toward a 2008-like bubble. Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting. This is crucial because excessive leverage is what allowed the bursting of the mid-2000s housing bubble to spiral out. The Federal Reserve poured newly printed (virtually printed) dollars into the financial system, driving interest rates. Standard Digital includes access to a wealth of global news, analysis and expert opinion. That closely watched metric of leverage stood at just 3.45 in early 2021. Low mortgage rates drove this housing boom in late 2020 and early 2021. “Eventually there’ll be a day of reckoning.During your trial you will have complete digital access to FT.com with everything in both of our Standard Digital and Premium Digital packages. “Real estate is suddenly pretty bubbly in almost every interesting market in the world,” said bearish investor Jeremy Grantham at a recent Morningstar Inc. If housing goes down, so does the economy. The housing market in 2021 looks an awful lot like the one in 2008, except this time the market is heating up after a recession rather than causing one. For most Americans, a home is their most valuable asset-as well as the collateral for a pile of debt. housing prices are now increasing by 15 percent a year or at their fastest pace in the past thirty years. House Prices Surpass Housing-Bubble Peak on One Key Measure of Value.

So are we staring at another housing bubble? One hopes not, because when the last one burst, it triggered a global financial crisis and what at the time was the deepest economic downturn since the Great Depression. According to the widely respected Case-Shiller index, at the national level, U.S. H ome prices are increasing at the fastest rate that we’ve ever witnessed since we first began collecting data just.

#Housing bubble 2021 software#

How do you make a rational offer on a house when you have irrational people in the game?” asks James Carmer, a software engineer who’s toured more than 100 houses in Austin. Monetary policy has caused this bubble, and only monetary policy will cure it. Today’s real estate market feels a lot like the bubble market circa 2006.

The euro area housing market during the COVID. The parallels are hard to ignore: the record prices, the bidding wars, the subdivisions that fill up as soon as they’re built, the resourceful buyer who clinched a deal by dropping off cupcakes that matched the home’s interior paint colors. Battistini, Niccol Falagiarda, Matteo Gareis, Johannes Hackmann, Angelina Roma, Moreno (November 9, 2021).

0 kommentar(er)

0 kommentar(er)